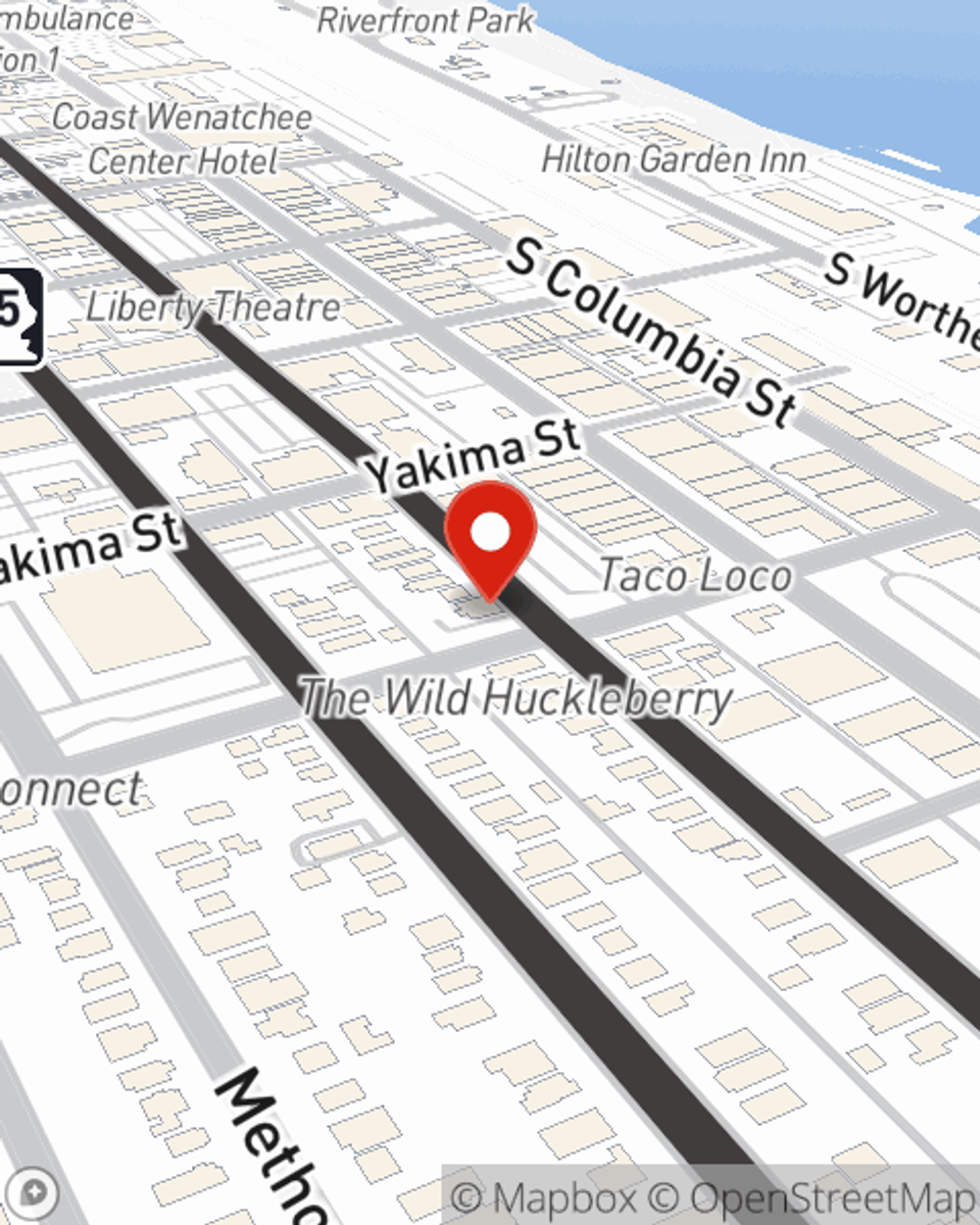

Business Insurance in and around Wenatchee

Wenatchee! Look no further for small business insurance.

This small business insurance is not risky

- Chelan County

- Douglas County

- Grant County

- Kittitas County

- Okanogan County

- Walla Walla County

- And Surrounding Area

Business Insurance At A Great Value!

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for your family. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, extra liability coverage and a surety or fidelity bond.

Wenatchee! Look no further for small business insurance.

This small business insurance is not risky

Protect Your Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a toy store, a photography business, or a book store, having the right protection for you is important. As a business owner, as well, State Farm agent Linda Sasseen understands and is happy to offer customizable insurance options to fit the needs of you and your business.

Call or email agent Linda Sasseen to talk through your small business coverage options today.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Linda Sasseen

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.